Over the past few years, collections work has changed in small ways. More contracts, more rules, and more pressure to get things done quickly, but many teams are still using emails, spreadsheets, and shared folders to get paid (Papaya Global, 2025). Industry research keeps showing that late payments and manual workflows have a direct effect on cash flow and operational risk (European Commission, 2022). That gap is where collection management software comes in. It’s not just something you want; it’s something you need.

This article explains what collection management software really does, who needs it, and how it helps the business in ways other than just speeding up the collection of money.

What Is Collection Management Software?

At the core, collection management software is a tool that helps teams keep track of all the stages of collecting documents and contracts, from demand letters and settlement agreements to approvals, signatures, and reports.

It focuses on process, visibility, and control, which is different from basic accounting tools. It brings together contracts, documents, approvals, reminders, and data in one place so that collections teams don’t have to keep looking for information in different tools.

In short, it makes things easier for legal, finance, and operations while keeping collections work organized and easy to find.

The Core Components of a Collection Management System

Most modern collection management systems have a few basic building blocks:

Centralized Document Management

All documents related to collections, such as contracts, agreements, and notices, are stored in one safe, searchable system. No more guessing which version is the last one.

Automating Contracts

In collections, speed matters, but consistency matters more.

Automated templates for demand letters, payment agreements, and settlements help teams get things done faster while making sure that the language is in line with company policies and legal requirements. Instead of having to rewrite the same documents over and over again, teams can make them right the first time.

Approval & Automation of Workflows

One of the most common causes of delay in collections is approvals getting lost in email threads (Kissflow, 2024).

Automation of workflows takes away that uncertainty and gives you clear steps to follow. The right people get approvals, they are tracked in real time, and they are automatically recorded. The system shows that something is waiting for a decision instead of making teams chase updates on their own.

E-Signatures & Digitalization

Built-in electronic signatures allow agreements to be signed immediately within the same system where they were created and approved. This cuts down on the time it takes to get things done and eliminates the need for external tools or manual follow-ups.

Reporting & Visibility

Without clear visibility, collections teams tend to work reactively.

Dashboards and performance indicators show teams where delays are happening, which cases are stuck, and how payment timelines are changing. This makes it easier to figure out what to do first, find problems, and change processes before they get worse.

Who Needs Collection Management Software?

You can use this kind of software in more than one field. People often use it for:

- Legal and collections teams manage a high volume of contracts

- Telecommunications companies that handle ongoing payments and contracts

- Financial services and credit teams that have to follow strict rules

- Legal, financial, and operational team issues are all part of large enterprise collections.

- Public sector or regulated entities that need complete audit trails

This software is necessary if collections involve more than just reminders, such as contracts, approvals, and compliance.

The Impact on the Business (Beyond Collections)

Collection management software does more than just speed things up.

- Shorter contract cycles mean faster resolution and more money coming in.

- Standardized templates and audit trails make it less likely that people will not follow the rules.

- More cooperation between departments that are working on the same cases

- Clear responsibility with records of approvals, changes, and access

- Using past payment data and patterns to make better predictions

Over time, teams move from reactive collections to structured, data-driven decisions.

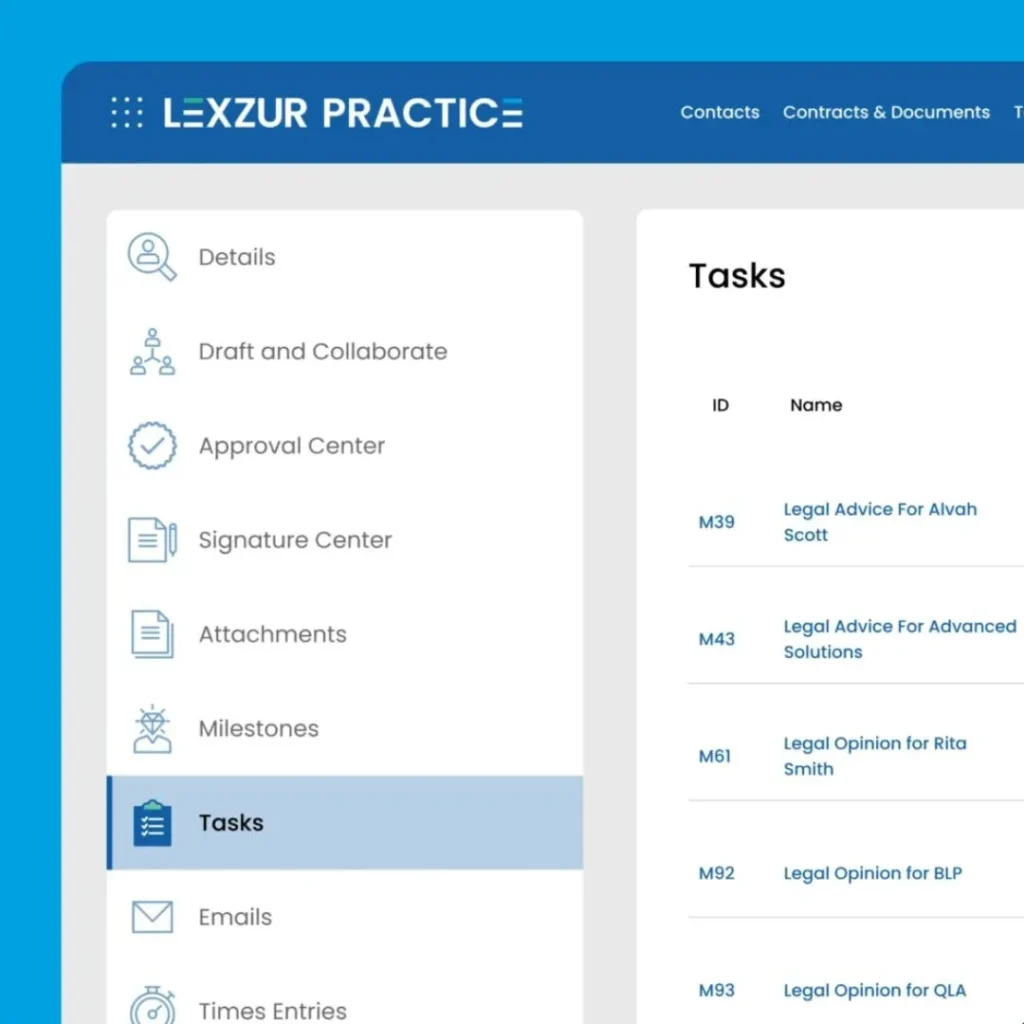

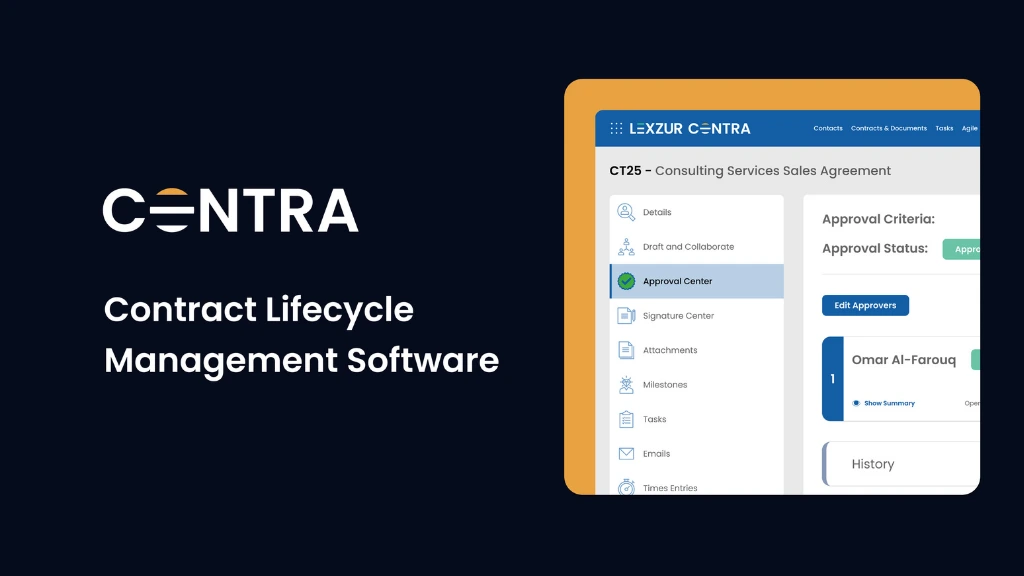

Lexzur Practice Software Features

Lexzur’s practice management system lets you manage collections by bringing contracts, workflows, and compliance together in one safe place.

Key features include:

- Automatically making contracts and other documents for collection workflows

- Approval centers that can be changed and watched in real time

- Signatures and integrations that are already built in

- Access to sensitive data that is safe and based on permission

- Custom dashboards and reports for tracking KPIs and performance

Lexzur Practice helps teams that do collections and legal work at the same time stay organized without making things more difficult.

Clients Who Trusted Lexzur Practice

Businesses in regulated fields use Lexzur to handle contracts, collections, and compliance needs on a large scale. These clients usually have a lot of paperwork to deal with, strict audit rules, and trouble getting departments to work together. This is where manual processes usually fail.

How It Compares to Other Collection Management Tools

Unlike older accounting and collections tools, modern platforms like Lexzur focus on contracts and workflows as well as balances.

| Area | Traditional Tools | Collection Management Software |

|---|---|---|

| Contract handling | Manual or external | Built-in automation |

| Approvals | Email-based | Configured workflows |

| Compliance | Fragmented | Centralized & auditable |

| Visibility | Limited | Real-time dashboards |

| Collaboration | Siloed | Permission-based |

When the number of items goes up or the rules get stricter, the difference is clear right away.

Things to Consider Before Picking a Software Solution

Before picking a collection management solution, teams should think about:

- Rules for keeping data safe and encrypting it

- Ability to automate approvals and documents

- Works with tools you already use, like email, storage, and CRM

- Reporting and KPIs that can change

- Easy to set up without needing a lot of IT help

The goal is to get people to use it, not just have another tool that sits around.

Frequently Asked Questions (FAQ)

What is a collection management software?

It is a platform where you can keep track of all the reports, approvals, contracts, and documents that have to do with collections.

How does Lexzur support collections teams?

Lexzur is a single system that includes contract automation, workflow management, e-signatures, and reporting.

Can Lexzur integrate with existing tools?

Yes, Lexzur works with popular platforms like Outlook, Gmail, Dropbox, SharePoint, and others.

Is Lexzur secure?

It has built-in security features like role-based access, encryption, and audit logs that help meet compliance needs.

Do teams need technical expertise to set it up?

No. Lexzur is made to be set up without any coding or a lot of IT work.

Collections don’t fail because teams aren’t doing their best. They fail because the systems aren’t made to handle how work really gets done.

Try Lexzur’s Collection Management System for free if your team is ready to centralize contracts, automate workflows, and see all of your collections at once. You might be able to get rid of a lot of problems in one place.

References

European Commission Joint Research Centre (2022). Assessing the economic impact of faster payments in B2B. https://publications.jrc.ec.europa.eu/repository/bitstream/JRC130247/kjna31169enn_2.pdf

Kissflow (2024). Workflow Automation: What it is and how it works. https://kissflow.com/workflow/workflow-automation/

Papaya Global (2025). Why manual processes are holding your business back. https://www.papayaglobal.com/blog/why-manual-processes-are-holding-your-business-back/

Leave a comment